Executive Talent Magazine

CEOs, investors, and employees are seeing the value of defining a company’s purpose to weather an uncertain business climate.

Some days the metaphor of businesses battling “headwinds” does not seem adequate to describe the polycrisis of uncertainty and disruption coming at corporate leaders. Climate change. Failing banks. Political unrest. ESG issues. The rise of AI. “CEOs deal with so many decisions stemming from external factors that will impact their strategic choices. But when leaders must act quickly, it’s easy to get distracted and make decisions based on the ‘Flavor of the Month’,” says Cristina Lilly, president North America and managing director, BCG BrightHouse. “Having a true sense of who you are and what you stand for offers a touchstone for decision-making. It’s about alignment with your purpose and values.”

But a company can’t just pick a purpose; “it has to be authentic to them. It’s not something we create or concoct out of thin air. It's part of an organization’s ethos,” says Lilly who sees her role as helping companies “excavate their purpose and use it more deliberately and intentionally.”

The business case for purpose

As Larry Fink, CEO of Black Rock said in his 2018 letter to CEOs, “Without a sense of purpose, no company, either public or private, can achieve its full potential.” According to Fink, without one, companies “will succumb to short-term pressures to distribute earnings and, in the process, sacrifice investments in employee development, innovation, and capital expenditures that are necessary for long-term growth.”

Lilly points to a Harvard Business Review report stating that employees inspired by purpose have more than double the output and productivity compared to satisfied employees, adding that inspired employees are 2.25 times more productive. Fink’s company Black Rock is the world’s largest asset manager with over $8.6 trillion in assets as of December 31, 2022, and when he writes his letter to CEO’s people take note. Other institutional investors have been following the lead and now, more than 150 financial companies with $82 trillion in assets collectively, including Black Rock, signed on to the recommendations of the Task Force on Climate-Related Financial Disclosures.

Investors are excited about purposeful action, but what makes CEOs excited? Part of it is that purpose helps define what makes a company unique and, therefore, what can help it stand out in the market. Lilly says she and her colleagues act like “anthropologists” going through a company’s history, having conversations with people throughout an organization, and digging deep to understand who they are when they're at their best — which Lilly defines as “having the knowledge of their unique strengths, characteristics, values, and beliefs.” Once they help a company unearth who they are at their best, they take an external view to uncover “the universal human need that [the company] can address,” Lilly says, and they bring in external thinkers they call “luminaries” such as psychologists, anthropologists, or even an orchestra conductor to help “open the aperture of how to look at what the company is really in the business of doing.”

Guiding through uncertainty

Having purpose and knowing a company’s values and beliefs help people understand why their work matters and helps them feel a sense of being part of something bigger than themselves, Lilly says. This is especially helpful when times are difficult, anxiety and fear are high, and the future unclear. “If you know who you are at your best, and you know the need you're serving, it helps you make decisions much more easily about what's in and what's out. You can focus, clarify, and align everyone.”

Knowing that you have a set of principles that can guide decision-making is valuable and allows an organization to more easily answer the questions, “Where do we go?” and “How do we get there? “From here leaders can evaluate their strategy. They can distribute decision-making. They can distribute leadership,” Lilly says. “And everyone in the organization is guided by those same principles.” In addition, knowing its purpose can help an organization attract and retain talent, particularly during in times of uncertainty. As Huber Joly, the former chairman and CEO of Best Buy, wrote in Harvard Business Review, “more than eight in 10 executives…think that a strong sense of shared purpose drives employee satisfaction, facilitates business transformation, and helps boost customer loyalty.”

Knowing that you have a set of principles that can guide decision-making is valuable and allows an organization to more easily answer the questions, “Where do we go?” and “How do we get there?

As Unilever CEO Alan Jope pointed out in a 2019 talk in Cannes: 64 percent of global consumers say they choose brand because of their stand on social issues; 91 percent of millennials would switch brands for one which champions a cause; and brands recognized for their strong commitment to purpose have grown twice the rate of others over the last 12 years. Lilly cites CVS as an example of a company that knows its purpose and used it as a touchstone to make significant changes. Because of this, they were able to make changes more easily. In 2014, CVS decided to stop selling tobacco products, knowing that would mean an estimated $2 billion loss in sales. Making this decision was a “bold and strategic choice to live their values,” Lilly says. “It was a character move consistent with their purpose — help people on their path to better health.” Later that same year, they officially changed their name from CVS Caremark to CVS Health, another signal of their commitment to their purpose.

Yet the company did not flounder under the revenue loss. It thrived. CVS made its decision in conjunction with a forward-thinking strategic plan “grounded in service of its greater purpose,” Lilly says. They increased their presence in retail health through MinuteClinics and, in 2018, acquired Aetna, a managed healthcare company with a network of providers and a leader in medical information and analytics. CVS is seeing “the benefits of living their purpose and values.”

Enduring Purpose

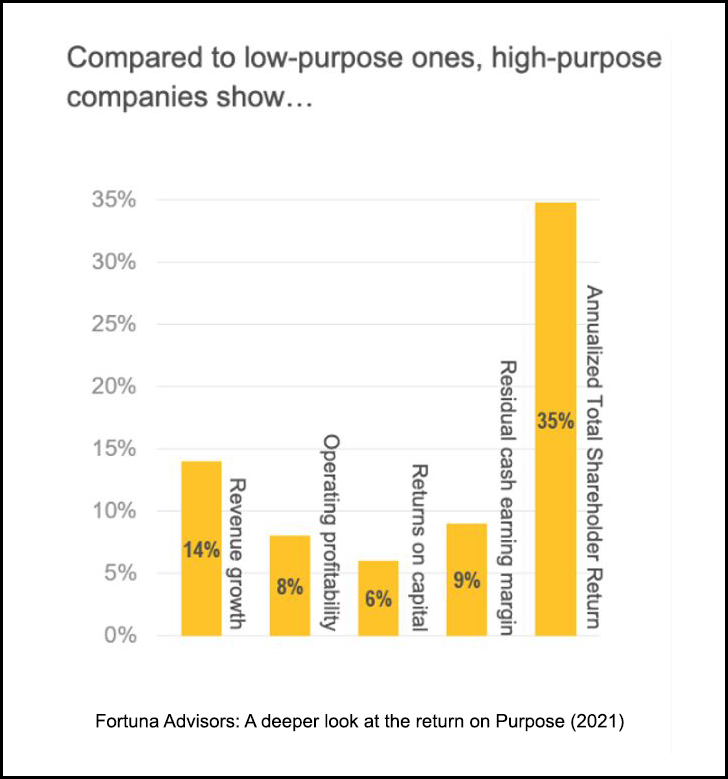

Companies are in the business of earning profits and are held accountable by shareholders. BCG BrightHouse has studied the correlation between a well-articulated and integrated purpose and 10-year total shareholder return (TSR). “Over time,” Lilly says, “there is a strong correlation between high purpose and higher 10-year TSR.”

BCG BrightHouse measures an organization’s purpose across four dimensions:

- Articulation – Do your employees know what your purpose is and are they aware of it?

- Alignment – Are employees aligned with your purpose, and do they derive meaning from said purpose?

- Integration – Is your purpose driving business decisions across the organization?

- Reputation – Is it driving an external perception of your company and/or brand?

“What we have seen is companies that have high purpose scores are more likely to have high 10-year Total Shareholder Return,” Lilly says.

These dimensions become more important as companies grow and expand their footprint. With employees disseminated around the world everyone must be clear on strategy and must be moving in the same direction. “We're no longer in a command-and-control leadership model,” Lilly says. “We’re able to give people the freedom to make decisions and give them the guardrails against which to do so because everyone is aligned.”

And even as a company grows and changes, its core beliefs, its purpose should be timeless. “When you articulate purpose, it’s at a 30,000-foot level,” Lilly says. “It’s not there to just address a timely problem.” She points out that there’s a difference between a company’s articulated purpose and its articulated vision and strategy, which need to address timely needs and will change with market dynamics. “Your purpose is your North Star,” Lilly says. “It’s your way finder to guide you for the long term versus your vision which sets your next goal, or the destination to reach in the next three to five years.”