“Africa possesses…a young and entrepreneurial population, territories that are transforming quickly with growing regions and rapid urbanization, considerable natural resources, dynamic economies, rich ecosystems and supportive diaspora."

From “Africa’s Development Dynamics: Growth, Jobs and Inequalities,” by the African Union Commission and OECD, 2018

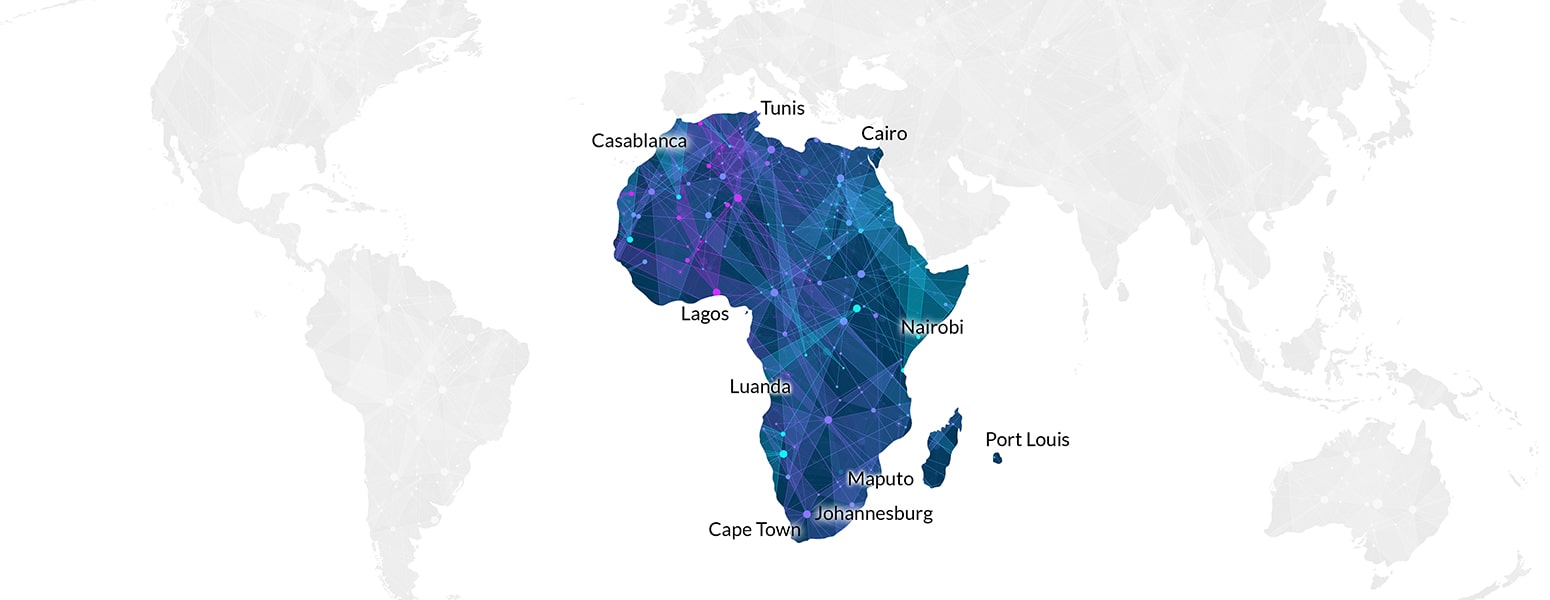

AESC in Africa

The Association of Executive Search and Leadership Consultants (AESC) is represented across the African continent in nine countries, including Angola, Egypt, Kenya, Mauritius, Morocco, Mozambique, Nigeria, South Africa and Tunisia. We spoke to 13 AESC member executive search consultants in Africa to tap into the pulse of African economies, the business climate across the continent and Africa’s demand for talent.

Africa in Context

To see the statistics of each country at a glance, download the full print version.

Discussing Africa as one market for executive search and leadership consulting requires a broad appreciation for the continent’s complexities. Annelize van Rensburg is a Founding Member of Talent Africa, now Signium Africa. “A lot of people think Africa is one place, one country, but every region is unique. West Africa cannot be compared to East Africa, cannot be compared to Southern Africa. Within those subregions, within East Africa for example, you cannot compare Tanzania with Kenya. You cannot compare it with Uganda. Each country is unique. I think that’s what a lot of people don’t understand about Africa—the uniqueness of each country, the different dynamics in each country.”

Take in for a moment that the African continent encompasses over 30 million square kilometers (11.73 million square miles) and is comprised of 1.324 billion people speaking an estimated 1500-2000 languages in 54 countries.

Fay Voysey-Smit is Managing Partner, South Africa at Boyden Executive Search. She describes “a very interesting map that I’ve seen, where China, India, Europe, the US and Japan actually fit into the African map because it’s so enormous. It’s also enormous in the diversity of people, culture, languages, trends, legislation, and tax laws.”

Additionally, it is not possible to neatly define how different regions or different individual countries on the African continent take to corporate working structures. Simpson Nondo, Managing Director at Stanton Chase South Africa, refers to the “pervasive colonial legacies which had impact and implications on how a lot of the continent is structured.” European colonialism, in particular, has had a lasting impact on Africa today, with respect to cultural and administrative influences. Notable colonizers included Britain, Portugal, France, Belgium, Germany and Spain.

The African continent encompasses over 30 million square kilometers and is comprised of 1.324 billion people speaking an estimated 1500-2000 languages in 54 countries.

For example, Nondo says, “You'll probably find that people from predominantly French-speaking African countries are emanating a typical French or Belgian influence, and so, too, are those who come from predominantly Anglophone countries probably reflecting a lot of English-based culture and/or tendencies toward how they work.”

Today, corporatization and globalization are transforming the continent. Malcolm Pannell is South Africa Country Chair at Korn Ferry. He explains, “There is an evolving picture of professionalization and increasing sophistication taking place.”

A significant factor in that shift is the ability to move goods and services. He says, “Logistics specifically is a very strong force in globalization and it has meant that markets such as those in Africa have been forced to compete with foreigners, simply because it is quite possible to move goods around the world in a far more efficient manner than perhaps was the case 30 years ago. This represents a long-term trend.”

Speaking of both the executive search profession and the whole of Africa, Voysey-Smit is optimistic. “Every country is different and it’s very complex. But the trend that I see is many global organizations are starting to really see Africa as strategic to their businesses and putting attention and investment into the continent.”

The Evolution of Executive Search in Africa

From the arrival of executive search in Africa, the profession has adapted to meet the complex needs of domestic and multinational organizations across the continent’s multiple countries and cultures.

South Africa’s Established Search Market

Anneke Ferreira, Managing Partner of Ferreira & Associates International Executive Search believes “better infrastructure and easier access make South Africa the gateway to the rest of Africa.” Executive search has been an important part of the management consulting suite of services in the country since the 1970s, but it’s only more recently begun to grow in the rest of Africa.

According to Auguste ‘Gusti’ Coetzer, a founding member and shareholder of Talent Africa, now Signium Africa, “Except for South Africa, the executive search industry is still very new here. It’s only in the last, I would say, 5 to 10 years that it has developed as a profession across most of the continent. But in South Africa executive search is established. It has a 50-year track record, but the profession is young in the rest of Africa.”

In South Africa, demand for the profession escalated during the country’s post-apartheid economic rise, which according to Goldman Sachs saw GDP nearly triple over two decades.

"South Africa is considered to be a young democracy having just celebrated 25 years of freedom, following the fall of apartheid. The country was very isolated from the rest of the world and when we were welcomed back into the international community, much changed. Odgers Berndtson Sub-Saharan Africa has been a part of this transition since 2004 when we opened up our offices and have had to navigate the changing political and economic landscape while offering the right advice and solutions to our clients to become a trusted executive search partner,” says Lauren van Halderen, joint Managing Director at Odgers Berndtson, Sub-Saharan Africa.

Beyond South Africa: The Growth of Search Across the African Continent

As executive search spread across the African continent, the profession became especially agile, learning to adapt to the various markets. According to Coetzer, “Each country has its own idiosyncrasies. A search in Nigeria could be quite different in the way you tackle it than a search in a more formal economy like South Africa.”

She adds, “Designing recruitment or talent acquisition practices for the whole of Africa is not going to work. There are too many local variances. You have to customize more than you would in Western Europe for that matter.”

With a wide range of maturity among African markets & the need to navigate complex cultures and systems, #ExecutiveSearch & leadership consulting in Africa now reflects the continent itself: resilient, resourceful, agile, & growing.

With a wide range of maturity among African markets and the need to navigate complex cultures and systems, executive search and leadership consulting in Africa now reflects the continent itself: resilient, resourceful, agile, and growing.

Mpho Nkeli is Director at Search Partners International (SPI) Executive Search, South Africa’s first executive search and leadership consulting firm, and a member of AltoPartners. She says, “Nigeria may be Africa’s biggest economy, however South Africa is the second largest economy and has a better infrastructure and financial services sector, which makes it quite attractive.”

She adds, “The nature of our market is an interesting mixture of first world and a third world in one—with some economic constraints, but we enjoy growth in a variety of sectors.”

The demand for professional services in Sub-Saharan Africa is likely to be met from one of three main ‘economic’ hubs in the region. Nondo explains, “While the market for retained executive search may exist sporadically in other African countries, most executive search firms operate from a few major cities on the continent—Johannesburg, Lagos, Nairobi.” He says, “There's just not the kind of critical mass of sustainable business opportunity when it comes to the corporate environment here. Each of these hubs would probably service neighboring countries from a search perspective, i.e. South Africa might service its neighboring South and Central African countries, Kenya its neighboring East African countries as well as Nigeria servicing its neighboring West African countries.”

Consider companies headquartered in South Africa with operations elsewhere. For example, van Halderen says, “If a mining company had the need to find a particular skill for one of their operations in Ghana, we would be contracted through the South African headquarters; similarly, if we were to conduct work for a bank in another territory or another African country. Sometimes it's more often the case that you would be contracted through the parent company in South Africa. However, what sets us apart, is our local knowledge and understanding of other territories on the continent. We would take into consideration the cultural norms or nuances, not only from a country perspective, but also from the company perspective too. So, while having the right skill sets are necessary, we also need to take care to look at the candidate, and ensure they are the right fit for the client.”

Nkeli says, “We work 80% in South Africa and 20% on the continent. We are working in about 21 African countries on the continent, driven largely by South African multinationals wanting to grow, wanting leadership skills on the continent, and sometimes European or American multinationals who are headquartered in South Africa and looking to grow in different African countries.”

Those multinationals are driving local companies to compete, and to do so requires professionalization. Pannell says, “What you see is more dynamic change in both East and West Africa. I guess one could say they are catching up, but the fact of the matter is they’re growing faster. And they’re seeking to professionalize quite rapidly. They are very hungry to develop talent and capability. Local organizations have to increasingly compete with multinationals.”

Businesses are increasingly turning towards local executive search firms to source talent. Tamer El Naggar is Managing Partner for Egypt at Boyden Executive Search. He says, “It is now becoming more common for a company hiring senior talent in North Africa, like Morocco or Egypt, to look for search firms in North Africa who have cultural understanding of the local environment, as opposed to going to a few global firms in New York, Paris and London. As much as there's globalization, there is also a very strong cultural layer that needs to be integrated into the executive search process.”

Businesses in Francophone countries in Africa are also adopting the principles of retained executive search and leveraging local expertise. Brinis says, “There are a lot of Anglo companies opening in French speaking countries, and they bring with them practices including executive search. Those companies will need to recruit with executive search firms that can provide both international reach and local expertise.”

Brinis adds, “The advantage of AESC membership is that we carry the high standards of AESC that bring trust to candidates and client companies. To be a member of AESC is a guarantee for the client that we are meeting the highest standards of executive search.”

Executive search, especially as its advisory services expand to meet the changing needs of clients, has a solid foothold in Africa, and has an opportunity to facilitate the evolution of organizations in Africa while the profession grows.

Growth in African Markets

Growth in African Markets

For example, Brinis says, “The economic environment is growing and the French speaking markets like Tunisia or Mauritius are receptive to executive search.” Increasing exposure to retained executive search is helping the profession gain traction in those African countries experiencing growth.

Expanding services is also a primary growth driver in the profession, worldwide. Many client relationships evolve: from one assignment to many, from one service to others. The market grows as executive search clients evolve into leadership advisory clients.

For Farah Samanani, Managing Partner, East Africa for Boyden Executive Search, “Our service is very niche, and we’re still educating the market.” She finds that one way to help educate clients and grow the profession is to establish the relationship first. “We don’t only go in pitching executive search; we service clients with other leadership offerings, and that often leads to executive search.”

For example, Ferreira describes “one of our international clients that had country managers in various countries. The company had grown to such an extent that they needed to put a more formal layer of C-level executives in those businesses that had grown large enough to require a CEO. So, that client would ask us to interview all of the country managers and assess their potential to move into a next layer, a more corporate-oriented, strategic, CEO type of role.”

The talent market in Africa is also driven by qualities that reflect the character of the continent: a desire to compete, optimism, local development, and diversity.

Bring on the competition

Much like the global investors eyeing opportunity in Africa, José Caetano da Silva, Founding Partner of Talent Search and a member of AltoPartners, sees opportunity in the profession. He says, “I believe that in the profession, there is a lot of room to grow, to create new markets.” Speaking of the profession in Mozambique and Angola, for example, he says, “We are typically boutique firms here. That means that if I work with two banks in the market, I should have some competitors working with other big banks.” Caetano da Silva believes that as the profession educates businesses in the region, more competition will enter the market, and he welcomes it.

Looking on the bright side

Many AESC members see the bright side of what might otherwise be considered barriers to growth. For example, while the state of the profession often mirrors the state of the economy, a struggling economy may signal the need for businesses to invest in top search advisory services. Halderen explains, “Many countries in Africa, including South Africa, are today facing economic and political headwinds. But if anything, this is the time when organizations need to be absolutely certain that a thorough, independent process is being followed when either considering new board members or executive leadership to lead these businesses. Organizations need a credible, trusted partner who has considered every aspect of due diligence around de-risking an executive-level appointment.”

While the state of the profession often mirrors the state of the economy, a struggling economy may signal the need for businesses to invest in top search advisory services.

In markets with a lot of contingency work, Caetano da Silva sees an opening for retained executive search. “We need to educate the clients, help them understand they need someone to work for them, not the candidates. Unlike contingent recruiters, we are corporate consultants, we are not working for candidates to find jobs,” he says. “We need to spread the word and help more and more corporations here understand that we address the talent market with corporate criteria and not career management criteria.”

The local movement

The expansion of retained executive search business is fueled by the rising interest from domestic clients. El Naggar explains, “While our clients are primarily international companies, interestingly there is a fast-growing segment of large, local corporations, regional corporations and companies, and family-owned businesses. This makes the story quite exciting because these markets have a lot of large, historically family-owned businesses that now are realizing the value of becoming corporatized with access to finance and access to international markets.”

El Naggar adds, “These large, family-owned companies are increasingly keen to look into aspects of governance, professional management and bringing people from outside the family to lead the organization. This is another driver for the profession in African markets.”

Diversity is driving growth

South Africa is determined to diversify the leadership ranks of publicly traded companies. Nkeli says, “We have seen an increase in board searches and what's driving this is the push for diversity of skills, thought, experience, race and ethnicity, and gender on boards. Listed entities are required to develop and have a board gender transformation plan—which has led to a growth of the NED practice.”

Generational change

“At this point in time, worldwide there is a big churn of baby boomers, and generation X replacing baby boomers in the C-suite,” Ferreira says. “We have a lot of assignments due to the retirement of C-suite individuals who need replacements.” Ferreira does not see the generational turnover as a challenge. “It’s actually a benefit. It stimulates a new generation, new energy in the C-suite.”

Meeting growing demand for executive search services requires developing talent within the profession. From El Naggar’s perspective, “We are seeing considerable growth from a humble base when it comes to these markets within Africa. In a very broad sense, it's a positive story. Concurrent with growing the profession and educating clients, there's also growing attention toward developing talent within executive search, so internally there's more training, market exposure, acquiring best practices from more developed markets into the region and obviously trying to develop local expertise.”

To provide some sense of scale, El Naggar explains, “If you look at the big business markets like Egypt, 100 million plus in terms of population, if you look at the executive search profession, you're probably looking at a maximum of maybe 40, 50 professionals, if not less. So it remains a very small market, but with growth potential.”

According to Pannell, “We sit in a bit of a dichotomy in a way, that we have very high levels of unemployment but skill scarcity at the same time. So the need for executive search, has, I think, been on a growth trend. And I think that that’s going to continue for some time as these economies mature.”

Acha Leke and Landry Signé wrote for The Brookings Institution ("Spotlighting opportunities for business in Africa and strategies to succeed in the world’s next big growth market", January 11, 2019), “Consider one question: How many companies in Africa earn annual revenues of $1 billion or more? Most global executives and academics we speak with guess there are fewer than a hundred. Many answer “zero.” The reality? More than 400 such companies exist—and they are, on average, both faster growing and more profitable than their global peers.”

These numbers may confirm the sense of AESC members, that the African market is rich in opportunities.

Challenges

AESC research confirms year after year that CEOs and CHROs are deeply concerned about their ability to attract and retain top talent. And worldwide, organizational leaders recognize the shortage of skills available in the talent market. Africa is no different.

The Skills Shortage

Voysey-Smit says, “Across the region there is definitely a skills shortage at the executive level, and the skill shortage is quite often more around leadership capabilities and real strategic capabilities rather than technical competencies, so that kind of higher order of skill, the person who is able to be learning agile, is able to embrace being flexible, is able to really accommodate a number of different aspects coming into a role and to be able to really lead a team—and lead a team of highly professional individuals. So that is where the main challenge is, and that is what our industry needs to address.”

A key challenge according to Samanani is “finding talent with the right skill sets.” One scarce skill set, she says, is “leadership talent who can make decisions without data.” She explains, “Kenyan education systems aren’t geared toward analytical thinkers or problem solvers. The system is not developing a lot of people with transferable skill sets who can also navigate the African context. Employers value Kenyans in the diaspora as they are more likely to have developed the analytical, critical thinking skills, plus the know-how to operate in Kenya. They also bring established networks and relationships versus expats.”

The new generation does not only want to live and work in one country. So, part of the talent loss is the departure of younger talent who want international experience.

The talent shortage is magnified by the drive, especially in South Africa, to attract diverse candidates. For van Rensburg, “We in South Africa also are very unique, because we have what is known as the Broad Based Black Economic Empowerment Act, which means that there is an element of equaling the playing field with previously disadvantaged individuals over those who were privileged in the past. Therefore, there is a high demand for qualified black professionals, so in our case, diversity includes not just gender, but also race and ethnicity.”

Ferreira points to “the pool of top talented people having a very large emigration rate.” She says, “We're hopeful that things will be turned around, but right now the economy is struggling, so, top talent is leaving due to the economic situation that the country is currently experiencing.” In addition, Ferreira says, “The new generation does not only want to live and work in one country. So, part of the talent loss is the departure of younger talent who want international experience.”

The Nigerian talent pool is facing a similar dilemma—keeping talent in the country. Enife Atobiloye, Managing Partner at TRANSEARCH Lagos comments, "We are dealing with about 200 million people here. Within the Nigerian population you will find two distinct groups—highly educated and accomplished professionals as well as massive untapped potential. What the two groups have in common is, that whether tapped or untapped, Nigerians are predominately talented people. Unfortunately, some of our best talent is fast migrating to other countries, like the US and other highly developed markets, because of the current state of the Nigerian economy. While Nigerians are consistently featured in studies as among the most educated ethnic groups in the US, for example, this hasn’t yet converted to a willingness to jump back to the opportunities opening up back home."

Go global to shop local

“There are very interesting and peculiar aspects about African intellectual capital in itself,” Nondo observes. “It's usually everywhere except where it’s meant to be.” He says, “Sometimes, to find a Kenyan executive for the Kenyan market, you have to have the capacity and capability not just to search in-market but also on a pan-African and or global level. And such talent invariably would only be keen to return on a quasi-expat basis, because that's what they're used to and that's the offer they would prefer to consider. For the candidate, It's the best of both worlds: returning to work at home, but on an expat basis.”

The desire for local talent is a growing trend, van Rensburg explains. “It’s an issue across sub-Saharan Africa. We did work for an international NGO that is headquartered in Kenya and the request was to first find a Kenyan, and if not a Kenyan, an East African. If that is not possible, they said they would open up to the rest of Africa, but very much they would like to have the position filled by an individual born on the continent.”

Do opportunities at home attract talent from abroad? Nondo sees “a lot of talent out there in the African diaspora who, given the right opportunity, would jump at the opportunity to come back home, where they would prefer to become a big fish in a smaller pond.”

Coetzer adds, “The myth that most diaspora, Africans who study abroad, are coming back to Africa, is not true. They often hold very good positions overseas, and normally if you speak to them, they will only return to their home country if they are paid an expatriate package.”

Instability

Serious challenges exist where markets are going through conflict or a political change. For example, El Naggar says, “Algeria, for instance, is a country that enjoys a high income per capita, but we've seen a change of political leadership earlier in the year. And it will become more and more stagnant until there is more stability on the political leadership level. So, that is honestly affecting some markets.”

“In Nigeria, households and organizations on average have about 35 hours of uninterrupted power supply per week,” shares Atobiloye. “This reality tends to bear even more heavily on certain sectors, like manufacturing, which must power factories. Besides the implication on costs, this is a major challenge for businesses because of the obvious need for seamless operations.”

Atobiloye adds, "Doing business in Nigeria requires resilience to deal with different issues that require rolling up one's sleeves. Organizations considering success in the Nigerian market must appreciate the fact that all infrastructures and systems are not in place. Businesses must be ready to take on a DIY approach to what may be a given elsewhere."

Employer brand

Clients of search expect executive search professionals to de-risk executive and board placements. What about the risk to executives placed in a precarious employment situation? “Good companies still attract top talent,” Nkeli says. But some employers “have reputational issues with the market, particularly now because there's a huge effort to cleanse corruption out of government.” She explains, “Some companies stand to lose credibility because of their underhanded dealings. These companies may struggle to attract and retain top talent.”

While helping a client survive a reputational hit is not something a search firm can do, Nkeli says, “Let me give you an example of what we have done. There's a company facing reputational challenges because of unbecoming historic business transactions. They appointed an excellent new CEO to turn around the business and restore it to its former glory. The CEO has brought credibility to the business, is turning around the company and engaged us to support him to enhance his board. This presented a challenging and interesting opportunity for senior non-executive directors with good turnaround experience—willing to jump into the fire, join the business and turn it around."

Nkeli adds, “Finding board members for this company was very difficult. However, we successfully placed credible and senior business leaders who wanted the challenge, who admired the new CEO and wanted to be part of the leadership to turn the business around."

Cultural barriers

Cultural barriers

El Naggar references Egyptian Vision 2030, and the mandate to increase women representation on boards in Egyptian listed companies. He says, “There's an ambitious target that the state has set for corporations. That sort of push needs the right professional services firms, and Boyden is trying to do its part by building alliances and trying to promote more women on boards, more inclusiveness, more diversity and to make sure that there's a conversation at a senior level in organizations.”

The challenge, according to El Naggar, is more of a cultural issue. He identifies “the old school type of organizations or industries where there is the misperception that in a blue collar, technical, industrial type of sector, a woman on the board would not be relevant. We’re trying to dispel that, and we’re trying to help bring the realization to companies here that having diversity improves the quality of conversations, brings a different perspective, improves governance, improves leadership, improves strategy development, and develops sustainable growth for the organization.”

Candidate mobility

According to Nondo, talent mobility is a consistently growing phenomenon: Talent is increasingly able to move not just in-country or just across African markets. It's moving internationally, where good talent may be looking for bigger, more advanced or more developed environments to go and develop professionally. And that's forever going to remain a real challenge for African markets.”

And in the competition for top talent, Pannell says, “Anyone worth their salt is probably subject to being approached for new opportunities multiple times in any year. It’s just the nature of the market, and that means that organizations have constantly got to be paying attention to their succession and their retention.”

An important part of retention, according to Samanani is “understanding the candidate’s motivation.” She says, “Getting great Kenyans to stay with a company is hard. They are constantly being poached by competing organizations. Kenyan talent is often motivated by cash more than opportunity or development. So retention is hard. You have to make sure the compensation is competitive.”

Candidate attitudes toward mobility sometimes necessitate the exclusion of otherwise qualified candidates. For example, Caetano da Silva says, “We don’t select candidates who keep moving among companies just because of salary. We keep searching.”

The fact of the matter is most African economies are really small, and if somebody has significant ambition, chances are they might need to work in other markets in order to realize that ambition.

“When an executive is in a role for nine months and the recruiter is asking ‘why are you not moving? We can offer more!’ This is terrible,” he says. “What I need is colleagues on the ground in African markets giving in each interview this feedback: I’m not short listing you because you need to deliver to your company. You need to pay back your salary.”

Caetano da Silva considers three elements in creating a short list of candidates: “One is background; that means experience. The other is soft-skills and personal characteristics; that means good leadership. And the other vector that is vital in the countries I’m addressing in Africa is the motivation for change; that means the reason to leave and the reason to come. We need to go deeper on this. In the near future, will he or will she move again? We need to be very, very strong in our filter and not go forward with this candidate.”

According to Pannell, “The fact of the matter is most African economies are really small, and if somebody has significant ambition, chances are they might need to work in other markets in order to realize that ambition.”

Retaining talent

In our environment today, retention is certainly a worrying topic for most leaders of business. According to van Halderen, “It is a very fluid and dynamic marketplace in South Africa. It's very competitive, and talent is being offered a lot of money and significant upside to move in a relatively short period of time from one company to another. So, there is a bit of a revolving door in certain functions and certain industries. This is a challenge many of our clients currently face and it has forced us to have to think differently in terms of how we can work with them to better manage disruptions in leadership. Succession planning, for example is becoming more and more necessary, especially in South Africa, where we need to consider how we are growing the next generation of leaders and developing more inclusive and diverse talent.”

Sometimes, clients need to understand that from a compensation perspective, one size does not fit all. Van Rensburg shares, “Often there are only so many people who fit specific qualifications in South Africa, so to get those, they come at a premium. But of course, a multinational doesn’t always understand that, because they have a global benchmark of people at a certain level within an organization getting paid a certain amount, so they’re looking at employing a person within that compensation band. But because there’s a shortage of very specific skills within South Africa, within specific diversity groups, etc., they’re shocked when you tell them, ‘That package will not attract people; you’ve got to come up with a bigger package.’”

For El Naggar, “I think another challenge is the difference in pay for talent in the North African region or in Egypt to be specific, versus adjacent markets like the Arabian Gulf, Saudi Arabia, and UAE. It is a bit of a challenge to try to pull talent regionally into North Africa away from higher pay in the Arabian Gulf or the better standard of living in Europe. So that becomes quite a challenge.”

Growing talent

Caetano da Silva says, “There is a shortage of talent here but we should address it, not just live with it.” One answer to the deepening skills gap is to develop talent within. Coetzer identifies, “The increasing need for companies to develop local talent and not rely on expatriates. Or if they bring in an expatriate, one of the first key performance areas for the expat is to recruit and develop locals.”

Pannell says, “One of the real difficulties is how to develop local talent, to get them to the level that will take your business forward. Education is a bit of an issue here. In some African countries, education systems aren’t necessarily conducive to developing high flying talent, and that means you are forced to source people who have at least been educated outside of the country. Developing a talent pipeline of executives and keeping that fully stocked and well managed I think is a very big challenge.”

Filling the talent pipeline across Africa can’t start at home until education and training meet the future needs of business. Despite the benefits of a young population, Van Rensburg observes, “What we do have, unfortunately, is a lot of wrongly skilled people, and that does not speak to the needs of the economies of Africa. Unfortunately, that’s one area where a lot of countries in Africa need an overhaul if we are going to compete in the global space for talent.”

For example, van Rensburg says, “We have good universities, we have good private schools, but public school education is deteriorating. It’s a major concern for our economies. We’re going to have a lot of young people who finish their 12 years of schooling, who are practically unemployable. That is one of the challenges of our economies, of our continent: the amount of young people who are not suitably qualified or educated to fill the jobs that are needed to be filled.”

Coetzer says, “There might be brilliant people in Africa, but only a handful who go to globally competitive schools and universities. I read a statistic the other day, that by 2040 there will be a 1.1 billion potential labor force in Africa. Now, that sounds like a lot, but it's the skills that are mismatched. On the African continent, some university degrees are really questionable in terms of competitive global standards. That's why your best talent in Africa often goes to study abroad.”

An opportunity for executive search AND LEADERSHIP CONSULTING

A search firm can help clients meet some of these challenges in part by helping them understand market differences. Nondo observes, “In one African market, for example, cash component of a remuneration package might be a preferable aspect of a salary structure, whereas in other markets it could be the (non-monetary) benefits offered. In other African countries it could be about lifestyle. That which might fit the American context because it's an American company might not be an optimal structure for a country such as South Africa, for example. “There must be flexibility to be able to tweak and adjust for local preferences.”

A search firm can help clients meet some of these challenges in part by helping them understand market differences.

In a particularly complex region like Africa, executive search and leadership consulting firms who know the local cultures, understand what motivates candidates and build deep relationships with their clients are uniquely positioned to address the full range of challenges in the market for talent. Doing so often requires the profession to exercise its agility and resourcefulness.

Leadership Advisory

Are search firms operating in Africa innovating to address client challenges in their markets? Brinis says, “From the beginning, I have not yet provided the exact same services twice.”

Brinis’s experience serving the unique needs of each client demonstrates the everyday innovation in the profession. “There is no single service we provide,” Brinis says. “We go to clients, we ask about their problems and we make a unique proposal on how to deal with their specific issues.” For example, he says, “Right now I’m working on how to create the organizational structure of a client company. It’s so exciting, as we deal with many companies’ cultures, sizes, and problems. What we are bringing is our experience and expertise, and we are customizing our services for each client.”

Caetano da Silva finds innovation in the profession helps clients attract and retain top talent. “Supporting clients’ leadership development efforts is an appropriate role for the profession. We do this with leadership services when we conduct management appraisals and propose a personal development program. We have some projects in this area, with good results. It’s definitely gaining traction, and this will be an important part of our business in the future.”

For van Rensburg, the profession is innovating “by offering a wider service than just search, including board strategy facilitation, to help boards to act in a more appropriate way.” She also identifies “the coaching that we’re offering under our leadership consulting side, where if a client can’t bring skills from the outside, then upskill from inside.”

Specifically, van Rensburg describes how, “A lot of our executive search firms are providing a gap analysis and upskilling, or looking at climate surveys to see where’s your organization, where do you want to be, and what can we do to help you get there with your current workforce. There are a lot of other things that we’re suddenly realizing have become a necessity, and we’re adapting to that.”

Executive Search has also had to adapt to the shift towards offering other services to clients, and this innovation often requires finding partners. Van Halderen notes, “Most of the big firms have now either acquired or grown practices that focus on leadership development, organizational development, understanding culture, and delivering programs and interventions around team effectiveness. We're seeing that executive search firms and leadership practice groups are partnering with respected business schools, as an example, to develop and offer executive education programs that can be delivered in conjunction with the search and placement services. But innovation also needs to be built internally which is why we developed our global LeaderFit® model. Our LeaderFit assessment suite was designed with a single objective of helping organizations evaluate their leaders’ capabilities and identify future growth opportunities.”

Voysey-Smit sees innovation in the de-risking of placements. “I think when you talk about innovation in our profession, what is very important is these value-added services around leadership assessment, leadership development, coaching, and mentoring. We know that you can do the best search in the world, you can put the best candidates into an organization, but if they’re not supported through the first three to 12 months in the organization, the risk is high. Our business really is about managing risk at the executive level and bringing in the people our clients need to ensure the success of their businesses.”

TECHNOLOGY

TECHNOLOGY

Nondo observes the innovative role search plays in market intelligence. “We're seeing a lot more clients looking to us to map the talent market, for example. That's largely because there's a realization that we are a good source of market intelligence; in most African countries, relevant, useable secondary data is not often readily available in the market.”

Ferreira has been investigating artificial intelligence technologies, “that could probably assist us in our business, speeding up processes. I think every business is probably doing this in the background, because the fourth industrial revolution is here.” However, she says, “There are still a lot of questions for me regarding transparency in artificial intelligence talent acquisition software.”

Voysey-Smit cautions, “One has to be very careful around how far you innovate and how much you can leverage technology. Human resources is about people and people need to be held carefully and valued. There needs to be a balance between how much we innovate around using technology solutions and how much it's still a hands-on, people business.

International Alliances

Alliances are essential to business in Africa, and most often predicated on either the legacy of colonialism or longstanding trade relationships.

“Indeed, colonial influences are still evident and remain of significance,” Nondo says. For example, according to Caetano da Silva, “In Angola and Mozambique we have a very strong relationship with Portugal. We are former colonies, we have the Portuguese schools, and the system is very much similar. In terms of business, every company in Portugal whether they do consumer goods, whether they do exports, have always had Angola and Mozambique on their radar and that’s good for us.”

In Tunisia, for instance, much of their international recruiting is from Europe. Brinis says, “As we are a Francophone country, it is easy for us to recruit from France, Switzerland, and the countries that speak French, where there is a natural alignment of culture and language.”

“This is what you have with alliances worldwide,” Brinis explains. “And after that we have some local and regional deals; we are linked with economic chambers of many countries, linked with government authorities for employment, and some embassies.”

In North Africa, El Naggar says, “The sources of foreign direct investment coming into North Africa by definition imply that agencies in the different receiving markets and source markets would cooperate and leverage that understanding.” He says, for example, “I may talk with my colleagues in the Middle East or Europe who work with Middle Eastern or European investors coming into Egypt, and the synergy of understanding between the client HQ and local market understanding adds lots of value to the search process. And that becomes instrumental for us to hire somebody in Egypt or in North Africa, people who would be able to integrate within that culture and deliver.”

Nkeli describes the influence of culture and language. “South Africa is a diverse country, for example, we have the largest Indian diaspora in the world and an attractive expat destination from European countries. We have easier relations with English speaking African countries than French or Portuguese speaking countries.”

Pannell says, “If you look at the history of the continent, you’ll understand why there are English, French, German, and to an extent, Italian connections in different countries.”

Kenya has a strong connection to the UK, Samanani says. “A lot of Kenyans will go to the UK for university. There is a strong connection there, but it is getting less important as an alliance. We are seeing more influence from the US and China, and a lot more Kenyans wanting to be better connected with the US or Chinese markets.”

New alliances are gaining traction. “Certainly, American influence has come today, not into specific countries in the same way as perhaps those other alliances have developed, but somewhat more broadly, and to some extent the Japanese around motor manufacture,” Pannell says.

He adds, “The Chinese have been very active, particularly in the African resources sector. So there are strong alliances. Some alliances are quite well established, but I think the growing one is most probably China, because of China’s appetite for resources.”

Looking Forward

“Outsiders have noticed that the continent is important and becoming more so, not least because of its growing share of the global population (by 2025 the UN predicts that there will be more Africans than Chinese people). Governments and businesses from all around the world are rushing to strengthen diplomatic, strategic and commercial ties. This creates vast opportunities. If Africa handles the new scramble wisely, the main winners will be Africans themselves."

From “The New Scramble for Africa,” The Economist, March 7, 2019

Voysey-Smit understands the ascendancy of Africa. “A trend that we are seeing now is that many global organizations are seeing Africa as having greater strategic importance for their businesses than it might have had previously. So Africa is seen as a growth region. We’ve got quite a burgeoning middle class, we’ve got burgeoning urbanization across the region, and that is impacting how global organizations see the region and see what they need to be doing in the region.”

Africa’s dependence on those global organizations may soon decline. Much like the drive to hire and develop Africans to meet the demand for executive leaders, African productivity will soon be poised to better meet the growing population’s domestic needs. According to Bloomberg, “We calculate that African industries have the opportunity to double production to nearly $1 trillion within a decade. Three-quarters of that growth is likely to come from manufacturing to substitute imports and meet burgeoning local demand.”

The future of Africa will also be more diverse and inclusive. According to El Naggar, “Organizations in Africa are becoming more likely to have conversations around diversity, around empowering women, empowering young leaders, and around sustainability. It is becoming less uncommon that we hear those conversations in the boardrooms when we’re meeting with companies in North Africa. And I think it’s also the responsibility of executive search firms to support that agenda and support that evolution.”

New African expats

What could happen when the population of much of the world is in decline? “The prediction is that Africa will surpass Asia with population, so we will then have more people living in Africa than anywhere else in the world,” van Rensburg says. “That population will also be the youngest population, even the working population will be younger than anywhere else in the world. When you consider the population decline in Europe where there will not be enough people to uphold the economy, I think at that stage, we might have to become the exporter of people.”

The leadership talent of that young population has the potential to be extraordinary.

“African people are naturally adapted to a VUCA environment: Volatile, Uncertain, Complex, and Ambiguous,” Coetzer says. So, if you can find African talent you’ve probably got a high success rate in terms of their ability to naturally adapt to volatility, uncertainty, complex situations, and ambiguous situations. You’ll find that companies recruit in South Africa and the rest of Africa for exactly this reason.”

Coupled with that, the profession should certainly be looking at how we can encourage business and political leadership to invest more in education, both in primary and basic education as well as tertiary. “We should be spending more time investigating how to solve some very immediate, very real problems right now, and we've also got to be thinking about how we solve for 20, 30, 40 years-time when we've got, hopefully, a very educated population of people with the resources to grow a truly competitive and powerful economy,” says van Halderen.

Pannell, too, sees the potential. “The economies in Africa are really quite small, however they’re fast growing, and if one can find a way to operate across the 54 countries and this massive landmass in an efficient way, then Africa represents an attractive market.”

“Africa can play quite a vital contributory role in the overall global picture,” he says. Realizing Africa’s rich potential requires leadership. Overall, we believe, there is a need for the work that we do, now more than ever. As, van Halderen says, “Organizations need to involve experts who have very global reach, who have developed networks, who have the ability to de-risk appointments, and identify people who are able to thrive and lead businesses in this time of uncertainty. Executive search firms have a role to play, not only in identifying external talent, but helping organizations diagnose internal team dynamics and effect success in existing teams who need coaching and support and external advice, as well as deliver world-class selection and search.”

In addition, she says, “Executive search firms have a role to play, not only in identifying external talent, but helping organizations diagnose internal team dynamics and effect success in existing teams who need coaching and support and external advice, as well as deliver world-class selection and search.”

Risk and reward

For Samanani, the outlook in Kenya “is still uncertain. There is a lot of potential and many opportunities where people can do well in the entrepreneurial setting. More often, when companies start here they have huge, wide-eyed aspirations, then they realize how difficult it is to work here. It comes down to public policy. If they can make it easier, there is a lot more potential for growth.”

According to van Rensburg, “Africa has major problems, but we also have major advantages, for example Africa can be the bread basket. If we can just get rid of corruption, we can provide food security for the world. We have people that are really amazing, that can help drive this. I think there’s just so much that can go right, but unfortunately as much that can go wrong if we don’t focus on the right things.”

The AESC search consultants who contributed to “Emerging Africa” while noting the many challenges facing this large and complex continent, share a common view: that the future of Africa is bright. As Nkeli says, “We have an abundance of sunshine.”

Get AESC SmartBrief for the latest in C-level news.