Executive Talent Magazine

Develop a deeper understanding of client relationships with executive search and leadership consulting firms. AESC surveyed 190 and interviewed a further 25 clients around the world.

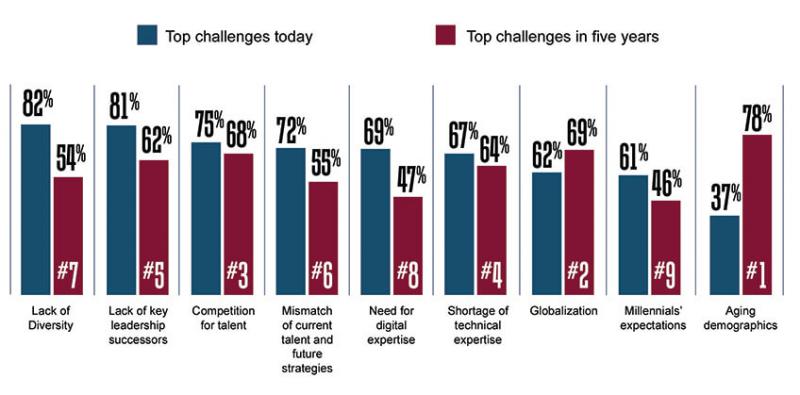

We started by asking about top challenges now and how those challenges inform the use of external advisors. ‘Lack of diversity’ is the number one challenge clients are facing today (Chart 3.1), perhaps due in part to continued government pressure in many countries around the world. Importantly, it’s 2016 and businesses finally understand the value that diverse leadership plays in driving innovation and business results. The executive search and leadership consulting profession can have a profound and lasting impact on their clients’ business by helping clients create a culture of inclusion and innovation and finding the best talent worldwide without bias. In just five years, clients rank this challenge much lower – we can only assume that they finally, perhaps optimistically, see the light at the end of the tunnel in terms of benefiting from diversity – in the leadership ranks, on boards, and with their total workforce.

Chart 3.1

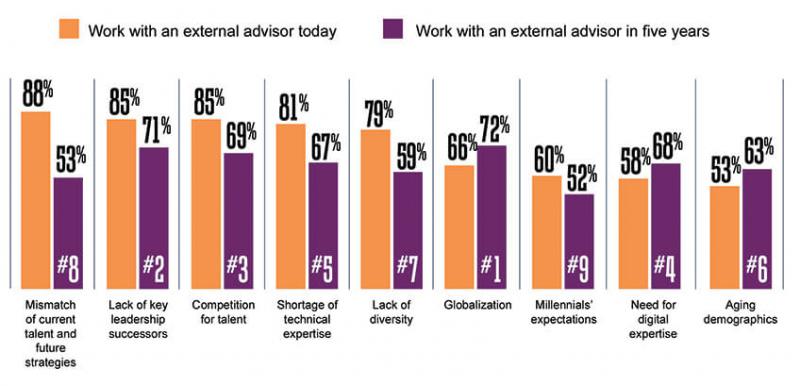

‘Lack of key leadership successors’ and ‘competition for top talent’ are also top challenges that clients are facing today – presenting more areas where executive search advisors can continue to provide value. Another answer that received significant responses was ‘mismatch of current talent and future strategies,’ which also ranked as the top area where clients would use external advisors today (Chart 3.2), showing that clients appreciate the strategic value that external consultants provide.

Chart 3.2

The Korean market is not a big one and is quite saturated. To grow our business we have to expand into overseas markets. We have to become globalized in our operations, our people, and our processes. When we hire executive talent, a search firm is not very helpful in the domestic market. But when we’re hiring people from other countries, we use executive search. There are some very good executive search firms who work in the Korean market and internationally.

Chihyun Park, Global Head of HR, CJ Corporation.

The number one issue forecasted in five years: aging demographics. Clients clearly look at their current senior talent and worry about what happens when so many retire. Coupled with future concerns about globalization and competition for top talent, it’s no wonder that succession is a critical issue today.

‘Competition for talent’ ranked in the top three both times – indicating the clear recognition that identifying and attracting the right top talent is critically important to business success. Clients value the use of outside advisors today and in the future to help them with their most critical executive talent strategies, including succession planning and the search for the right top talent.

In relation to the use of external advisors, only one of the top three responses changed: ‘globalization’ topped the list, while ‘mismatch of current talent and future strategies’ fell away in significance. These results show that clients are optimistic about the initiatives they are prioritizing (diversity, aligning business and talent strategies), and their concerns for the future are at least partly based around concerns for megatrends (globalization, demographic shifts) which will pose a new set of challenges.

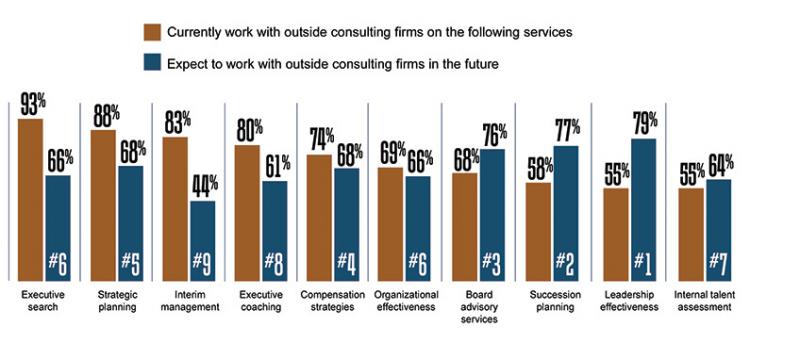

While these questions speak to the trends and concerns that clients are facing, we also wanted to gain insight into the external services that they currently use and expect to use in the future (Chart 3.3). There is demand today from more than 68% of clients for seven out of the ten services listed, indicating that there is clearly value in the use of external consultants for executive talent solutions. All three of the service areas where there is less demand currently – succession planning, leadership effectiveness, internal talent assessment – increase in expected future demand. This is in line with the areas in which AESC members expect to see an increase in the future, demonstrating that executive search firms are broadening their service areas based on client demand.

Chart 3.3

We’re a business that is going through transformation driven by technology. The impact of that on combining new hires and skills with the legacy of expertise we have is probably the biggest challenge we have faced. But one of my big hang-ups is people talking about their business being digital: we’re a publishing business that uses digital. We’re doing what we’ve always done, but we do it in a different way.

Neil Morrison, Group HR Director, Penguin Random House.

Clients are already retaining outside advisors for every service listed in chart 3.3, overleaf with only three falling below 68% use. Interestingly, three of the four least-used services today have moved up to the top three positions forecasted for use in five years. Executive search dropped to the sixth position, indicating the client’s desire to do more work in-house in this area, however the percent is still strong and is forecasted by many to remain the same or increase (see additional analysis of the future use of executive search starting with Chart 3.5).

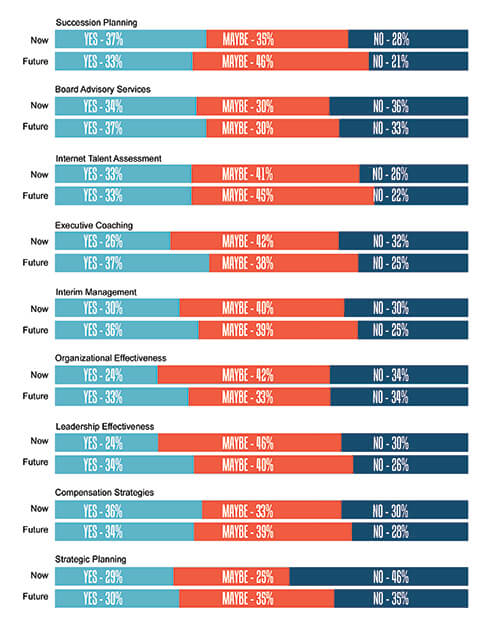

While there is demand for executive talent solutions from external advisors, are executive search and leadership consulting firms well-placed to provide the services? We asked clients which additional advisory services they would use executive search firms for today and in the future (Chart 3.4). The “maybe” category is the most telling – 30 – 46% of clients indicate they are open to using their current executive search firm for this broader range of advisory services in the future. We can only conclude that the value provided in terms of deep industry and functional knowledge combined with achieving the status of being “trusted advisor” on top of executive talent issues encourages clients to think, “how can we partner with our top executive search advisors more broadly on our top talent challenges?”

Chart 3.4

By combining the ‘yes’ and the ‘maybe’ responses, we can see that there is a real opportunity for clients and executive search firms to partner together on a broad range of leadership services that focus on executive talent strategies. In seven of the nine services, at least 66-79% of clients are open to working with executive search firms, and in all but one of these areas the future interest increases even more. This shows the natural chemistry between executive search and the leadership consulting services listed. Many executive search firms are already partnering with their clients in these areas, and we expect to see this grow in the future.

The Competitive Market for Executive Search

When I am outsourcing, I want expertise. I have no problem if executive search firms build up other service areas, but I do think they have to keep their level of expertise in search as well, because that is what I’m hiring.

Neil Morrison, Group HR Director, Penguin Random House.

While charts 3.1 to 3.4 provide a road map for potential future opportunities, today executive search revenues account for an average of 92% of our member firms’ revenues. In this section we explore the competitive forces specifically for executive search, compared to three recruitment services: in-house talent acquisition, contingent recruitment, and recruitment process outsourcing (RPO).

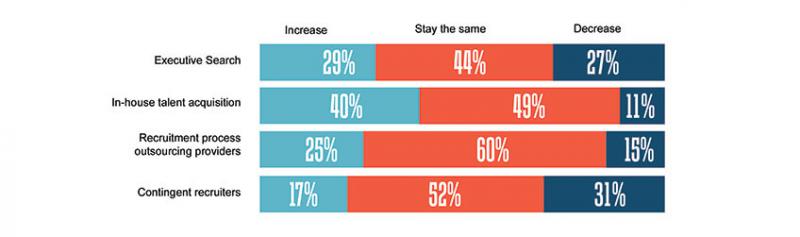

We first asked how clients expect their use of the executive search advisory service contrasted with recruitment services to change over the next five years (Chart 3.5). Almost three quarters (73%) of clients expect their use of executive search to either increase or stay the same. In-house talent acquisition remains strong, with 89% of clients expecting their use to either increase or stay the same. The outlook is least positive for contingent recruitment, where 31% of clients expect to reduce an already small segment of their service purchase.

Chart 3.5

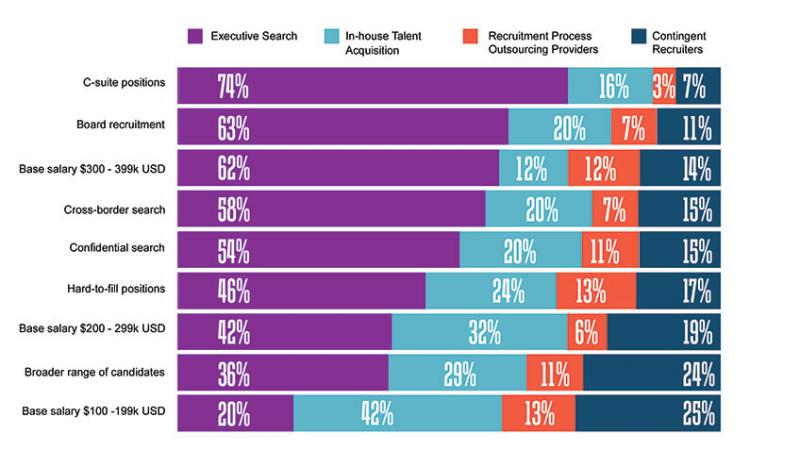

When looking at the scenarios in which different services are used, we get a clear picture of the sweet spot for executive services (Chart 3.6). Of the nine scenarios that we listed, executive search is the most used in eight of them and is particularly strong in searches above $300k USD, board searches, C-suite searches, cross-border, and confidential searches. Once a search is $200k USD level or higher, the competition with executive search falls away, showing that as the seniority and difficulty of a search increases, a more consultative service is required to deliver the best results.

Chart 3.6

This chart also contrasts in-house talent acquisition and contingent recruitment. Clients are more likely to use in-house talent acquisition over contingent recruiters in eight of the nine scenarios. This helps to paint a picture of the landscape for talent acquisition services.

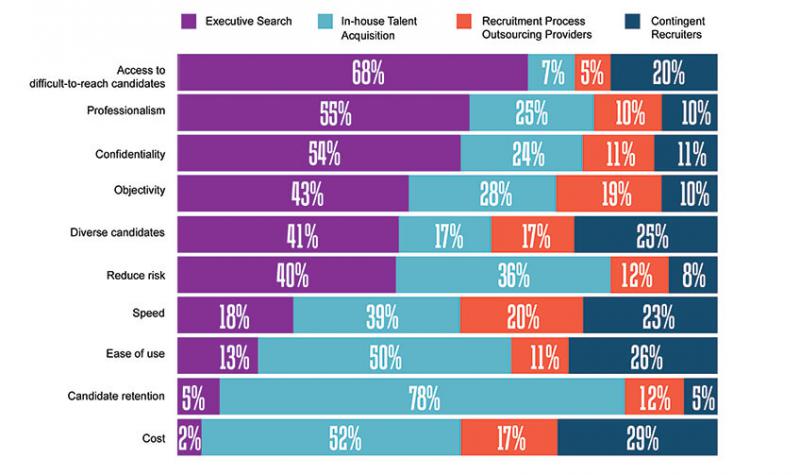

We asked why clients decide to use different forms of talent acquisition, and what qualities appeal to them about each of the services (Chart 3.7). Once again, executive search dominated several categories, specifically professionalism, confidentiality, and access to difficult to reach candidates. In addition, executive search ranked highly for objectivity and diverse candidates.

Chart 3.7

Executive search is used when the executive position is strategic and high impact – positions where trust (professionalism, objectivity and confidentiality) can make the difference between attracting the right talent and missing out. In-house talent acquisition functions are seen as stronger in operational issues – cost, speed, and ease of use. In-house talent acquisition also scored highly for candidate retention. However, based on our surveying of executive-level candidates, we know that the tenure of executives is longer when they are placed by AESC members, and therefore we expect the low ranking for executive search may simply mean that this isn’t a primary reason for choosing executive search rather than any implication of actual results achieved.

The phrase ‘trusted advisor’ is a good way to describe any partners we work with and has good application to the search firms we work with. We work with them on a highly-confidential basis and they have integrity, which is very important.

Masao Torii, President, Representative Director of Boehringer Ingelheim Japan Co., Ltd.

Firm Selection

While the research up until now helps us to understand the market for executive search and leadership consulting, we also wanted to get a sense of how firms are selected once a client decides they would like to work with an executive search firm. If the market for executive search is defined by seniority, difficulty, and a commitment to high standards of service, the most important factor for selecting individual firms relies heavily upon the consultant and firm’s industry and function knowledge. Clients also value the trusted advisor relationship developed with the executive search consultant.

The phrase ‘trusted advisor’ is a good way to describe any partners we work with & has good application to the search firms we work with. We work with them on a highly-confidential basis & they have integrity, which is very important.

While ‘lack of diverse leadership’ was the top concern for clients, an executive search firm’s diversity track record only ranks eighth when selecting an executive search firm. AESC members understand the importance of having open and frank conversations with their clients about their goals regarding diversity and are committed to helping their clients find the right talent, without bias. Clients may assume this as a given.

One interesting area where clients and candidates had different perspectives is the executive search firms’ involvement with onboarding. In our candidate survey this was raised multiple times as an area where executive search firms could be more involved, but not a single client identified it as an important issue when selecting an executive search firm. Clients often feel they have the onboarding process well-developed internally, but our candidate research indicates that they see gaps and would welcome additional onboarding support to help them accelerate their ability to “hit the ground running” and contribute to business success more rapidly.

Executive Search Metrics

To understand the expectations of service, we wanted to find out more about the significance of different metrics for measuring a successful search. When asked whether they use internal metrics to gauge the success of an executive search, there was an almost 50/50 split: 56% said yes and 44% said no. Considering the level at which executive search firms work, as defined earlier, it is surprising that such a large number of clients do not formally measure the success of an executive search assignment. This is an area where executive search firms could assist clients; it would surely be of benefit to have data to demonstrate the adherence to high levels of professional practice.

We also asked clients to indicate which metrics are/would be most meaningful to them (Chart 3.8). The business performance of the placed candidate over time was the top response in the ‘highly important’ section, while the tenure of the successful candidate was the second most-frequently mentioned response. It’s clear that the success of an assignment is not simply measured by filling a seat. The ultimate success should be evaluated in terms of short-term and long-term business impact aligned with business requirements.

Chart 3.8

I need to know what type of skills and backgrounds are available on the external market, and compare that to what we have internally. I have a pretty clear idea in my mind of the type of person we are looking for in a search.

Glenn Powell, Director of Employment Equity, Augusta University

Looking at metrics that rank as ‘important,’ but not necessarily ‘highly important,’ we see answers related more to the operational side of an assignment: cost per hire, time to completion and time to first slate of candidates, were the top three responses. This once again demonstrates that clients are principally concerned with the strategic value of an executive search, but retain an interest in the operational side as well. Two of the top three responses in the ‘important’ category are directly related to speed. When dealing with finding the right talent to fill the most critical executive positions, losing time means losing opportunity. But we also balance this with the importance of taking the time to find the right executive that will deliver the highest impact over the long-term. Executive search advisors have a strong sense of urgency coupled with a strong understanding of the competitive landscape. We understand the pressure to manage both the top line (long-term business impact) along with the bottomline need for cost management. We also know the value of our consulting methodologies from finding the right talent, to assessing for fit and developing a candidate relationship that helps get the right person to say “yes” when an offer is made. Short-cutting these processes by selecting a “low cost provider” may save you a small percent today, but could in fact create the ultimate high cost of a bad hire.